Aluminum plates and aluminum materials are two important forms of aluminum products, which are widely used in many fields.

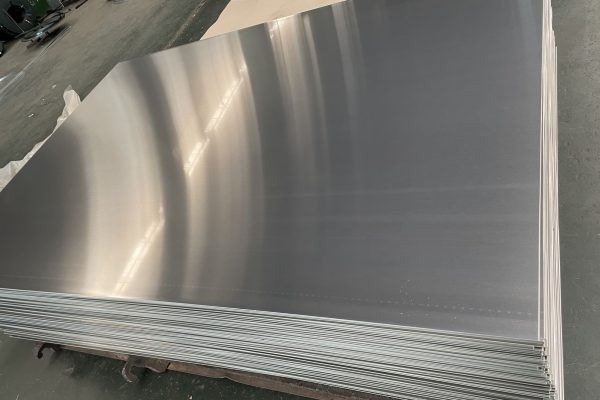

Aluminum plate: refers to a rectangular plate rolled from aluminum ingots, with a thickness of more than 0.2mm and less than 500mm, a width of more than 200mm, and a length of less than 16m.

It is divided into pure aluminum plate, alloy aluminum plate, thin aluminum plate, medium-thick aluminum plate, patterned aluminum plate, etc., and is mainly used in construction, decoration, machinery, chemical industry and other fields.

Aluminum materials: In addition to aluminum plates, it also includes aluminum products in other shapes, such as aluminum foil, aluminum tubes, aluminum extrusions, etc.

Aluminum has a wide range of applications, involving many fields such as industry, decoration, molds, solar energy, automobiles, and home decoration.

In addition, the export volume of aluminum plates and aluminum materials plays an important role in my country’s aluminum product exports. For example, in October 2024, my country exported 538,000 tons of aluminum materials, including 300,000 tons of aluminum plates and strips and 134,000 tons of aluminum foil.

On November 15, 2024, the Ministry of Finance and the State Administration of Taxation issued the “Announcement on Adjusting Export Tax Refund Policies” (No. 15, 2024). Starting from December 1, 2024, the export tax rebates for 34 tax numbers for copper and aluminum will be cancelled. Export tax rebates for 24 tax numbers. By then, all export tax rebates for copper and aluminum products will be cancelled. Which means the cost of aluminum materials will be higher at least 13%.

The adjustment of the export tax rebate policy may have a certain impact on the export of aluminum materials. Enterprises need to pay close attention to policy changes in order to adjust their business strategies in a timely manner。